Why the EU Needs to Reconsider Their Deforestation Law

Key Things to Know About How EUDR Affects the U.S. Pulp and Paper Industry

The European Union (EU) issued a new law in 2023 called the European Union Deforestation-Free Products Regulation (EUDR). The law is part of the comprehensive EU Green Deal.

EUDR aims to curb deforestation and forest degradation that could be linked to the import or export of certain commodities in the EU. We support what the EU is trying to achieve with their anti-deforestation law.

We have a long history of sustainable forest management. We also have a track record of success in environmental stewardship.

The U.S. pulp and paper industry is not linked to global deforestation and forest degradation.

However, as with all laws and regulations, details matter. EUDR, as currently written, imposes some unachievable requirements that create significant technical barriers, which risks trade between the EU and the U.S.

Let’s explore why the anti-deforestation law puts the U.S. pulp and paper industry at risk. We explain:

- How a company complies with the law

- Why the U.S. pulp paper industry does not contribute to deforestation and forest degradation

- The complexity and impractical nature of the traceability requirement

- Why the traceability requirement would disrupt trade

- A workable solution to avoid trade disruptions

The European Union Deforestation-Free Products Regulation went into effect in June of 2023. The law aims to fight global deforestation and forest degradation by regulating certain products entering or leaving the EU market.

This law is unprecedented because of the requirements it imposes to comply with the law.

It requires EU importers and exporters to prove their agricultural products are:

- Deforestation and forest degradation-free after 2020

- In compliance with country laws

- Supported by a mandatory Due Diligence Statement and extensive accompanying data

The EU’s deforestation law has multiple requirements companies must comply with. There are 3 key conditions to put products in or out of the EU marketplace:

- Proof the products do not contribute to deforestation or forest degradation.

- Product production follows the laws of the country where they are produced. That includes complying with:

- Environmental protection regulations

- Land-use rights

- Forest management rules

- Labor laws

- Tax laws

- Human rights laws

- Every shipment is accompanied by a due diligence statement which includes comprehensive information:

- Product trade name, description, name(s) of tree species, and quantity.

- Geolocation of all plots of land from which the product originates, with time and date range of production.

- Contact details of supplier and client d. Upload all data through an EU Central Information System

Companies and producers must comply starting December 30, 2024. Those not in compliance can be fined and have their products seized.

1/3

of the U.S.

is forested

1 Billion +

trees are planted

each year in the U.S.

For 30 years

net forest area has

increased steadily

The U.S. pulp and paper industry is not linked to global deforestation and forest degradation.

Today, U.S. forests are stable, healthy and growing:

- 1/3 of the U.S. is forested.

- More than 1 billion trees are planted each year.

- The net forest area in the U.S. has increased steadily in the past 30 years.

Our industry is committed to sustainable forest management best practices including:

- Forest certification programs to provide standards, guidelines and structure for sustainable forest management.

- Fiber sourcing programs that are third-party verified and are recognized globally.

Additionally, AF&PA members adhere to sustainable fiber procurement principles as a condition of membership. Procurement is how our members get the wood they need to make the products we rely on

These principles assure the suppliers our members source wood from are committed to sustainable forest management and harvesting practices.

We also have a 2030 sustainability goal to advance more resilient U.S. forests. It’s part of our Better Practices, Better Planet 2030: Sustainable Products for a Sustainable Future initiative.

Our goal furthers our efforts by enhancing the diverse values forests provide. Things like water, carbon, biodiversity, recreation and forest products.

We’re doing this through:

- Supporting conservation and restoration programs and initiatives

- Engaging in partnerships and investing in research, outreach and education

- Promoting sustainable forest management practices

- Committing to increased supply chain transparency regarding responsible sourcing.

As part of Better Practices, Better Planet 2030, AF&PA members will also continue their commitment to procure wood fiber through certified sourcing.

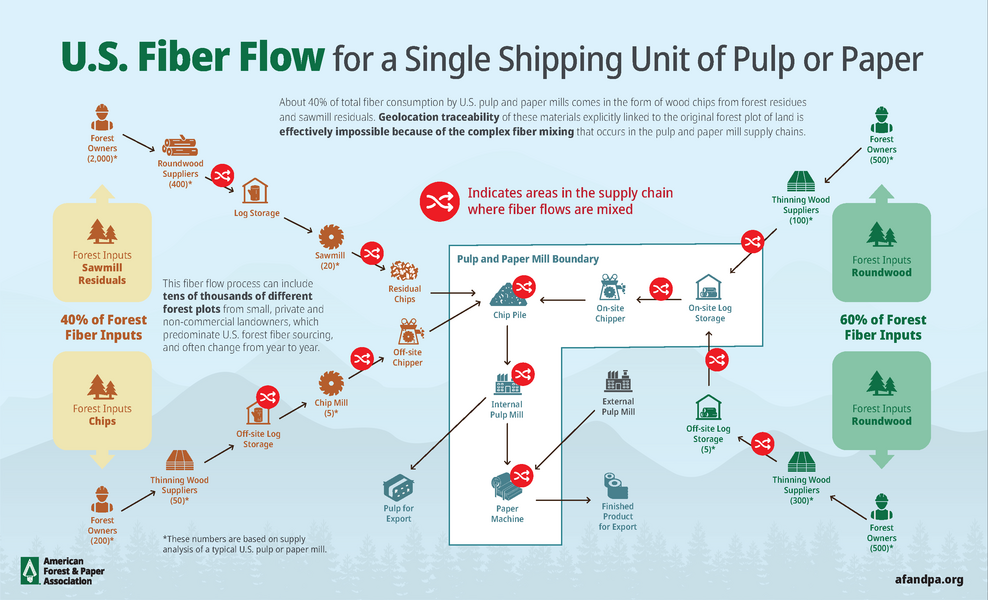

What’s concerning for our industry is how EUDR will be implemented, especially EUDR’s strict geolocation traceability requirements. This requirement could pose technical trade barriers for U.S. companies based on our complex supply chain and fiber flow process.

Let’s break down the traceability requirement and why U.S. producers cannot currently comply with it.

The EU’s deforestation law requires producers to trace each product shipment back to the specific real estate plots of land that is or could be linked to the shipment. That means providing the exact geographic location coordinates like those from a GPS.

In addition, each exporter must identify and provide contact information from the supply chain associated with each shipment. This is part of their due diligence obligations.

This may sound good in theory, but pulp and paper supply chains are complex.

In the U.S., more than half of forest land is owned and managed by an estimated 10.6 million private forest owners. These private forests provide about 90% of the wood to make forest products.

Our industry uses multiple wood inputs from these:

- About 40% comes from leftover materials from a sawmill or forest residue. Forest residue includes branches, stumps, bark and more that are left over after a thinning or harvest.

- About 60% comes from solid wood harvests.

Our use of leftover materials and forest residues is one of the ways we’re helping advance the circular economy.

The wood inputs used to make a single batch of pulp at a mill can come from multiple sources. This is called a fiber flow.

That’s because wood and wood chips mix throughout the supply chain including:

- Initial storage of a log or leftover material

- Chipping process at a saw, chip or pulp and paper mill

- Chip pile at a pulp and paper mill

- Pulping process

- Paper machine

The EUDR’s strict geolocation and traceability requirements pose significant challenges because of our industry’s complex supply chains.

The leftover materials from sawmills and forest residues our industry uses are regularly blended multiple times throughout the production process.

This makes tracing each individual wood chip from the original forest plot of land to a final product effectively impossible.

Additionally, the technology needed to trace our fiber flow to comply with this requirement does not currently exist.

The unachievable traceability requirement could cause major trade disruptions between the EU and the U.S.

The EU relies on pulp and paper imports from the U.S. We export around $3.5 billion worth of products to EU countries.

We also supply about 60% of the specialty pulp EU manufacturers use to make diapers, menstrual and incontinence products. The U.S. supplies 85% of the specialty pulp used globally.

EU manufacturers would not receive the supply of specialty pulp needed if U.S. pulp and paper manufacturers cannot overcome the technical barriers of the traceability requirement.

This would cause significant trade disruptions between the U.S. and the EU and disrupt the EU marketplace.

We encourage the European Commission to consider the challenges EUDR poses for the U.S. pulp and paper industry to avoid major trade disruptions.

The U.S. pulp and paper industry is a responsible steward of our planet’s resources. We have long history of sustainable forest management and innovation.

The U.S. pulp and paper industry is not linked to global deforestation and forest degradation.

We are a strong proponent of international efforts to suppress deforestation and forest degradation. This is why we need to be considered a “low-risk” country.

That’s why we need a realistic solution that recognizes U.S. sustainable forestry management and will enable our producers to comply with the intent of the EU deforestation-free regulation without disrupting trade between the EU and the U.S.

We are not alone in our concerns with the implementation of EUDR:

- The U.S. Congress has weighed in multiple times through bipartisan letters from both chambers:

- Members of the U.S. Senate urged the U.S. Trade Representative (USTR) to engage with the European Commission to gain clarity around the regulation’s requirements.

- Members of the U.S. House sent a letter to USTR.

- The U.S. government called for a delay in a joint letter.

- Multiple EU members called for a delay in implementation.

- Other key members of the U.S. forest products industry value chain have asked the European Commission to delay the implementation.

We believe in balanced and achievable regulations. We welcome the opportunity to work together with EU regulators and other stakeholders in the implementation of EUDR.